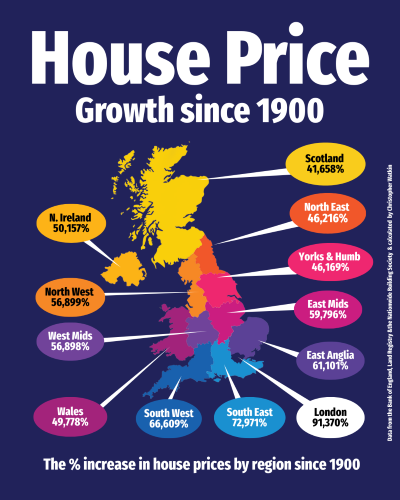

House Prices Since 1900

At first glance, the numbers in this chart look almost absurd. In many parts of the UK, house prices are now forty, fifty, sixty, even ninety thousand per cent higher than they were in 1900. London sits at the extreme end of that scale, but every single region tells the same underlying story.

Yet those headline percentages are doing something unhelpful. They make the growth feel explosive, dramatic, even irrational. When in reality, what we are looking at is not a series of wild leaps, but the slow, steady effect of time doing the heavy lifting.

If you strip it right back and annualise the growth since 1900, 126 years ago, the picture becomes far more grounded. Across most regions, long run house price growth works out at around four and a half to five per cent per year, compounded. London is higher, some regions are lower, but the order of magnitude is remarkably consistent.

That matters, because it explains why housing feels so relentlessly expensive to each new generation. Prices do not jump overnight for most of history. They grind higher year after year, decade after decade. Wages move too, but rarely in quite the same smooth upward line. The result is that buying always feels hard at the time you are trying to do it.

And that is the uncomfortable truth at the heart of the British housing obsession. We all want house prices to go up once we own. We all feel the pain of them being high when we are trying to buy. Both things can be true at the same time.

What history shows us very clearly is this. Waiting for some dramatic reset has rarely paid off. Over the medium to long term, prices have always recovered and moved higher. The people who benefit most are not those who timed the market perfectly, but those who got on the ladder when it was right for them and let time do the work.

That does not mean buying at any cost or at any moment. Affordability, job security, lifestyle and personal circumstances all matter. But it does mean that if you are waiting purely because you think prices will suddenly become cheap, history is not on your side.

The lesson from more than a century and quarter of property market data is simple and quietly powerful. Property rewards time in the market, not attempts to outguess it.