Latest Property News

- Details

- Hits: 887

Frome Buy-to-Let is Dead: Long Live the Frome Buy-to-Let Landlord

Future legislation and the recent Budget have stirred considerable anxiety among landlords. The Chancellor's decision to increase the additional Stamp Duty Land Tax (SDLT) from 3% to 5% for landlords purchasing additional properties initially suggested a grim outlook for the buy-to-let sector. This move, coupled with the introduction of the Renters' Rights Act, which proposes to abolish Section 21 and effect a landlord database, poses new challenges for Frome landlords but also opens doors to new opportunities. Despite these hurdles, deeper market insights reveal reasons for optimism among property investors.

- Details

- Hits: 777

£ per square foot October 2024

Welcome back to news of Frome's property market, where each week we bring you different local property market stats and trends. This week we are back again with the October’s £/sq.ft statistics.

The average property presently in Frome is on the market for £358 per square foot, a figure representing the current heartbeat of Frome's property market.

Last month it was £357 per square foot.

- Details

- Hits: 1516

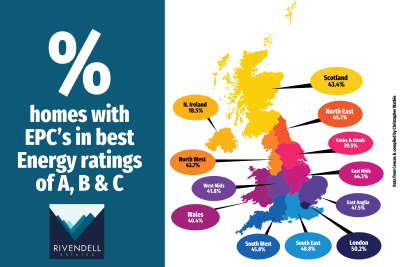

% homes with EPC’s in best Energy ratings of A, B & C

This infographic provides a snapshot of the percentage of homes across twelve UK regions that have achieved the best Energy Performance Certificate (EPC) ratings of A, B, or C.

EPC ratings measure a property’s energy efficiency, with A being the most efficient. The data reveals a substantial variation in energy-efficient homes across the UK.

- Details

- Hits: 978

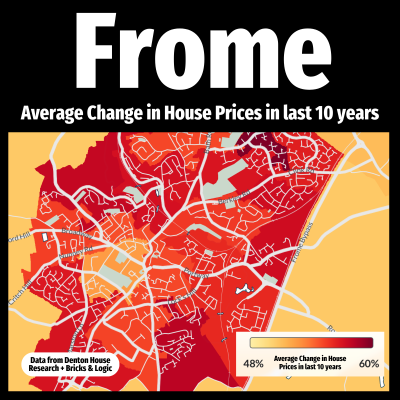

Average Change in House Prices in the last 10 years

UK house prices have risen by 65.4% since 2014, yet the reality is that growth in property prices in the UK and indeed Frome has differed from city to city, town to town.

Looking closer to home, Frome has also experienced a varied rise in house prices, much like the wider UK property market, again rising at differing rates in the different neighbourhoods, depending on the specific area. As shown in the map, darker redder areas represent those with higher average house price growth, while lighter yellow colours indicate more modest increases.

- Details

- Hits: 844

Frome October ’24 Property Market:

A Comprehensive Overview for Buyers and Sellers

Are you a homeowner in Frome? Perhaps you’re planning to move/sell/buy within the next six to twelve months, or maybe you're on the lookout for your next dream home and have no timescales. Whether you're buying or selling, having a clear understanding of the current state of the property market in Frome is vital to make informed choices.

You might be an investor in the Frome buy-to-let sector, contemplating selling or expanding your portfolio. Or perhaps you’re a Frome first-time buyer wondering if now is the right time to jump on to the market. Regardless of your situation, knowing whether the property market in Frome favours buyers or sellers can significantly influence your strategy.