Latest Property News

- Details

- Hits: 247

The 40 Year Rental Shock

The shift in private renting over the last 40 years is one of the most misunderstood trends in the UK property market. Everyone knows it has grown. Very few know by how much.

This graphic shows the percentage growth in households renting privately in each region since the early eighties. Some areas have risen modestly such as Scotland at 40.9%. Others have risen sharply such as the West Midlands at 118.3 % and the North West at 115.7%. Every region has moved, but the pace has varied.

It is neither a good thing nor a bad thing. It is simply what has happened.

- Details

- Hits: 253

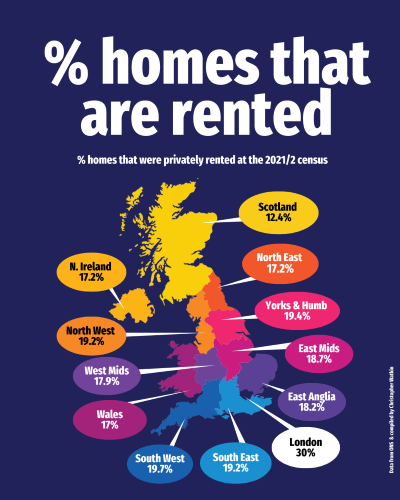

Where do people rent the most across the UK? And why it matters for anyone living in Frome

The census data on private renting is more revealing than most people realise. It shows how different the housing landscape is from one part of the UK to another and why every homeowner, landlord and buyer in Frome should care about the trend.

Here is the list in order from highest to lowest.

- Details

- Hits: 263

My Thoughts on the Budget for Frome homeowners & landlords

The Autumn Budget delivered the expected changes to housing and taxation, although the impact will be felt more in sentiment than in immediate cost. The centrepiece was the new annual levy on homes worth more than £2m, due from 2028. Owners of £2m plus homes will pay more and the rest of us will pay more through the wider tax system. None of it was a surprise. The charges are £2,500 a year for homes above £2m and £7,500 for those above £5m. It is a London centred measure that affects fewer than 1% of properties, yet it creates a clear psychological line that will shape behaviour between now and 2028.

- Details

- Hits: 256

£ per square foot November 2025

Welcome back to news of Frome's property market, where each week I bring you different local property market stats and trends. This week I am back again with the November’s £/sq.ft statistics.

The average property presently in Frome is on the market for £364 per square foot, a figure representing the current heartbeat of Frome's property market.

Last month it was £364 per square foot.

- Details

- Hits: 234

Are there more homes for sale across the UK?

The data shows an intriguing north-south split in the UK housing market.

Here’s how the regions compare for the change in the number of homes for sale in October 2025 versus October 2024: