Latest Property News

- Details

- Hits: 294

Frome House Price Review: The January 2026 Update

Frome homeowner or landlord? Curious about the trends in the Frome property market? One measure is the average price paid for homes bought and sold in Frome in the last 12 months, on a rolling month by month basis.

Each month I like to share this figure, and whilst this figure alone will not tell you much, its trend will. My followers on social media know I write regular articles on the Frome property market. It is in those articles I expand and clarify what these monthly figures mean to you.

- Details

- Hits: 254

UK Property Market 2025 vs 2024, A More Local Story Than Ever

This comparison of UK homes, spilt down by regions sold subject to contract in 2025 versus 2024 shows a market that is steady overall, but increasingly shaped by local conditions rather than national headlines.

Several regions have seen encouraging growth in house sale volumes. The East Midlands leads with transactions up 5.6%, closely followed by the West Midlands at 4.6%. These areas continue to benefit from a combination of affordability, sensible pricing and consistent buyer demand.

- Details

- Hits: 261

What will the interest rate drop mean for Frome homeowners?

The latest 0.25% interest rate cut is not a game changer on its own. On a typical average sized variable mortgage, the monthly saving is modest £31per month. However, the real impact is not the pound notes, it is the mood.

Property markets do not run purely on numbers. They run on confidence, expectation, and sentiment. This rate cut, combined with falling mortgage pricing, sends a clear signal that the direction of travel has changed.

- Details

- Hits: 333

Average price of a semi detached home

The UK has a lifelong love affair with the semi-detached home. It is the backbone of suburbia, the street-by-street footprint of growing families, and for many of us it was where childhood happened. Semis offered just enough space to breathe, gardens to play in, neighbours close enough to feel part of something, and privacy without the isolation of detached living.

- Details

- Hits: 254

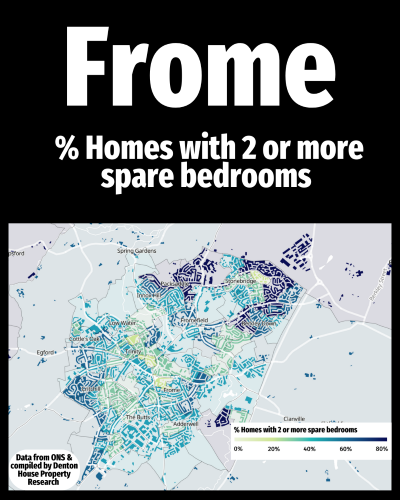

Fromes Spare ‘Spare’ Bedrooms

There is something very British about holding on to spare bedrooms. Many households in Frome have one, but a sizeable number have two or even three that sit untouched most of the year. The map reveals pockets of the town where large proportions of homes have significant unused space, especially in the darker shaded areas.

Is that a good thing? Well, yes and no.