Latest Property News

- Details

- Hits: 442

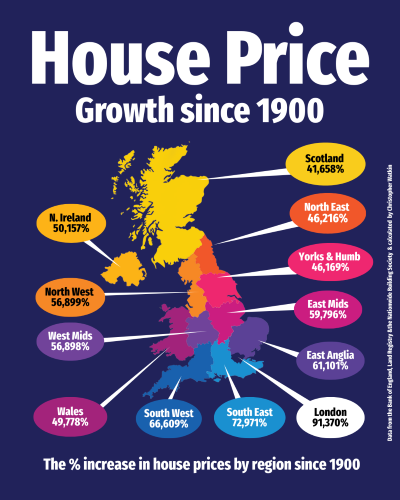

House Prices Since 1900

At first glance, the numbers in this chart look almost absurd. In many parts of the UK, house prices are now forty, fifty, sixty, even ninety thousand per cent higher than they were in 1900. London sits at the extreme end of that scale, but every single region tells the same underlying story.

Yet those headline percentages are doing something unhelpful. They make the growth feel explosive, dramatic, even irrational. When in reality, what we are looking at is not a series of wild leaps, but the slow, steady effect of time doing the heavy lifting.

- Details

- Hits: 234

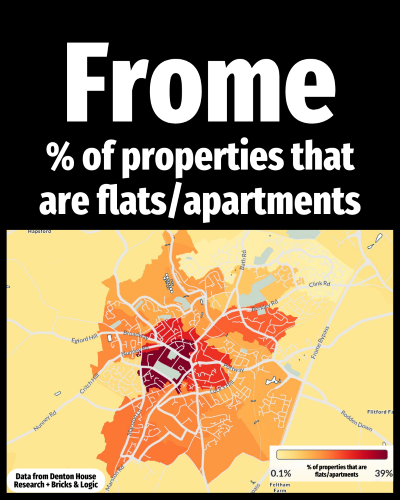

The % of homes that are flats / apartments

At first glance, Frome looks like many other market towns. Scratch beneath the surface and the pattern of homes across the town tells a far more interesting story.

This map shows the percentage of homes in Frome that are flats or apartments, broken down by neighbourhood. The darker the red, the higher the proportion of apartments. The lighter yellows indicate areas dominated by houses. Where the map turns grey, there are effectively no flats or apartments at all.

- Details

- Hits: 224

How many days does it take to sell a property in the UK?

Fresh figures show the average time from a home coming onto the market to being marked as Sold STC is still measured in weeks rather than days. While many properties do go on to sell, it is worth remembering that only around one in two homes that come to market actually achieve a sale. The remainder are withdrawn unsold, which underlines the importance of pricing correctly from the outset.

- Details

- Hits: 204

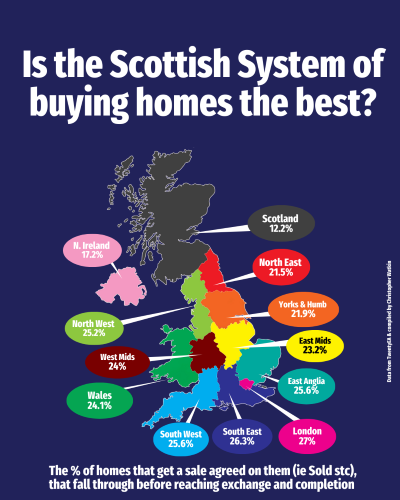

Is the Scottish system of buying a home better?

This map is a stark reminder of where the English and Welsh home buying system still lets people down.

Across England and Wales, between roughly one in five and more than one in four agreed sales fall through before exchange and completion. That is not down to poor agents, bad buyers, or flaky sellers. It is down to a system that delays certainty until far too late in the process.

- Details

- Hits: 198

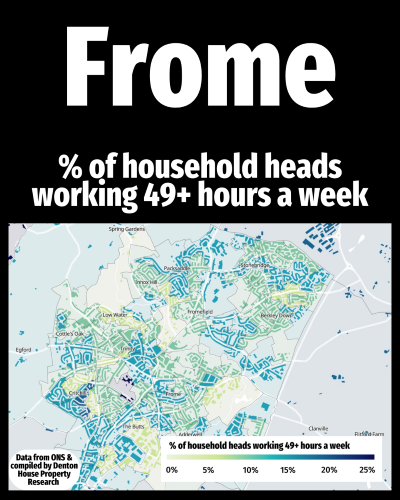

The % of people who work 49 hours or more per week

As an estate agent in Frome, I am dedicated to understanding the unique aspects of our local community to better serve our clients.

Using data from the Office for National Statistics and the recent Census, this heat map illustrates the percentage of working residents in different areas of Frome who work more than 49 hours per week.